Use the information for the question(s) below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt. KD has had consistently stable earnings, and pays a 35% tax rate. Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

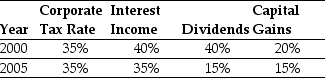

-Assume the following tax schedule:

Personal Tax Rates  Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Definitions:

AGI

Adjusted Gross Income, which is gross income minus adjustments, and serves as a basis for calculating taxable income on an individual's tax return.

Qualified Higher Education Expenses

Expenses related to education, such as tuition and fees, required for enrollment or attendance at an eligible educational institution.

Nontaxable Distribution

A distribution or payout from an investment or account, such as a return of capital, that is not subject to income tax.

Nondeductible Contributions

Payments to certain accounts like IRAs where the investment is made with after-tax dollars, hence not tax-deductible.

Q7: Using the FFC four factor model and

Q10: List three kinds of real options that

Q15: The total value of the levered firm

Q16: Assume that in addition to 1.25 billion

Q37: Consider the following equation: C = S

Q43: Assuming that Kinston has the ability to

Q63: If Flagstaff currently maintains a .5 debt

Q69: The WACC approach does not require knowledge

Q71: The unlevered cost of capital for Armadillo

Q83: Which of the following statements is false?<br>A)