Use the information for the question(s) below.

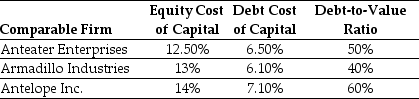

The Aardvark Corporation is considering launching a new product and is trying to determine an appropriate discount rate for evaluating this new product. Aardvark has identified the following information for three single division firms that offer products similar to the one Aardvark is interested in launching:

-The unlevered cost of capital for Armadillo Industries is closest to:

Definitions:

Super Bowl

An annual championship game of the National Football League (NFL), which marks the culmination of the professional American football season.

Property Interest

A legal right or interest in a tangible or intangible object, which provides the holder certain privileges regarding the use, disposition, and possession of the property.

Restrict

To limit or control the size, amount, or range of something through regulations or conditions.

Uniform Commercial Code

A comprehensive set of laws governing commercial transactions in the United States, designed to harmonize the law of sales and other commercial contracts.

Q5: Which of the following statements is false?<br>A)

Q9: What is the purpose of the sensitivity

Q11: Which of the following statements is false?<br>A)

Q18: Which of the following statements is false?<br>A)

Q33: The amount of net working capital for

Q41: Using options to reduce risk is called<br>A)

Q51: This graph depicts the payoffs of<br>A) a

Q52: If a firm purchases a piece of

Q57: If KT expects to maintain a debt-to-equity

Q69: If Rosewood had no interest expense,its net