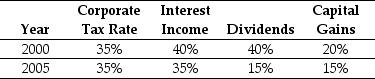

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax rate for equity holders was closest to:

Definitions:

Convertible

A type of financial security, such as a bond or preferred stock, that can be converted into a specified amount of another type, typically common stock, at the holder's option.

Bond Yields

The amount of return an investor realizes on a bond, usually expressed as a percentage of the bond's value.

Present Value

The present worth of a future sum of money or series of cash flows, when discounted at a specific rate of interest.

Coupon Payment

The interest payment made to the bondholders by the issuer of the bond.

Q2: Which of the following statements is false?<br>A)

Q4: The effective dividend tax rate for a

Q9: The volatility of a portfolio that is

Q13: Canadian bankruptcy law was created to ensure

Q21: Which of the following statements is false?<br>A)

Q27: If the risk-free rate of interest is

Q30: The amount of net working capital for

Q35: Which of the following statements is false?<br>A)

Q39: The expected return of a portfolio that

Q42: Which of the following statements is false?<br>A)