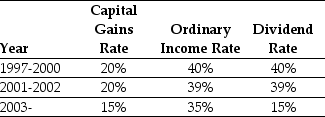

Use the information for the question(s) below.

Consider the following tax rates:  *The current tax rates are set to expire in 2008 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire in 2008 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a buy and hold individual investor in 2006 is closest to:

Definitions:

Q2: Which of the following statements is false?<br>A)

Q21: Which of the following statements is correct?<br>A)

Q23: Using the income statement above and the

Q28: Which of the following statements is false?<br>A)

Q28: The risk-neutral probability of an up state

Q38: Equity in a firm with debt is

Q56: The reason that the Air Transportation Safety

Q59: The unlevered beta for Blinkin is closest

Q72: Fill in the table below showing the

Q81: Which of the following statements is false?<br>A)