Dennis Corporation entered into a long-term lease for a piece of equipment.The lease term calls for an annual payment of $2,000 for six years,which approximates the useful life of the equipment.Assume a discount factor of 16 percent.(Note: Present value of a single sum factor at six years and 16% is 0.410; present value of an annuity factor at six years and 16% is 3.685.)Round answers to the nearest dollar.

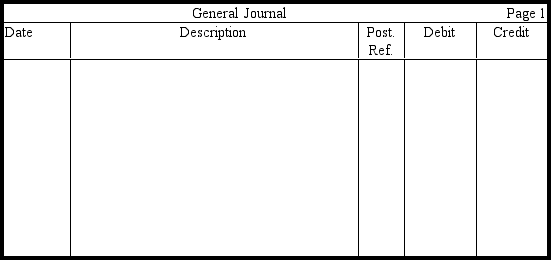

a.Prepare the entry without explanation to record the leased equipment.

b.Prepare the entry without explanation to record annual depreciation,assuming the straight-line method and no residual value.

c.Prepare the entry without explanation to record the first annual payment of $2,000,after the company has had the equipment for one year.

Definitions:

Psychotherapists

Professionals trained to diagnose and treat mental health issues through various forms of talk therapy.

Attention Deficit Hyperactivity Disorder

A neurodevelopmental disorder characterized by inattention, hyperactivity, and impulsivity.

Ritalin

A stimulant medication commonly used to treat Attention Deficit Hyperactivity Disorder (ADHD) by affecting certain chemicals in the brain.

Psychiatrist

A medical doctor specialized in diagnosing, treating, and preventing mental, emotional, and behavioral disorders, often through medication.

Q1: A company receives $180 for a sale,of

Q13: On a bank reconciliation,outstanding checks are deducted

Q18: The calculation of cash for interest to

Q61: On January 2,2013,Barham Corporation issued ten-year bonds

Q110: Which of the following typically would not

Q139: Florence Corporation sold for $20,000 plant assets

Q147: If a revenue expenditure is incorrectly recorded

Q167: On December 1,Grenada Company borrowed $80,000 from

Q223: A capital expenditure results in the recognition

Q233: In the journal provided,prepare entries for the