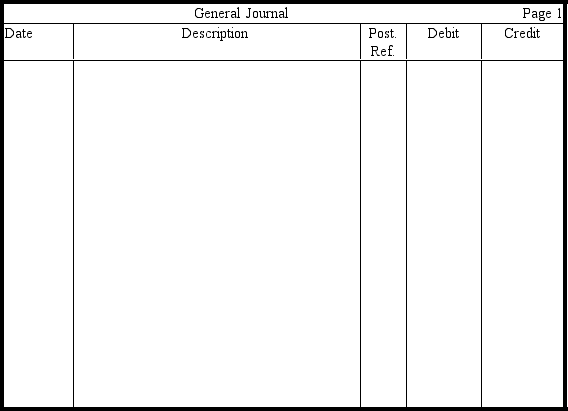

In the journal provided,prepare entries for the following independent transactions.(Omit explanations.)

a.Purchased land and a building on the land for $960,000.The appraised values of the land and building are $350,000 and $650,000,respectively.

b.Paid $5,000 for a sewage system,$15,000 for a parking lot,$1,000 to tear down a shack on land just purchased,and $10,000 for a block wall.

c.Purchased a truck two years ago for $18,000 with an original six-year estimated useful life and $3,000 residual value.After a full two years of use,revised the residual value to $4,000 and the useful life to a total of seven years.Record depreciation for year 3,assuming the straight-line method.

d.Purchased a machine on May 1,2013 (assume a calendar-year accounting period)for $15,000.The machine has an estimated life of 10,000 hours and no salvage value.Record depreciation for 2013 under the production method,assuming that the machine was used 2,000 hours.

Definitions:

Characteristics

Features or qualities that distinguish a person, object, or phenomenon from others.

Heredity

The passing on of physical or mental characteristics genetically from one generation to another.

Social Factors

Elements within a society that influence individuals' behaviors, attitudes, and life outcomes, such as family, education, and economic status.

Attribution Theory

is a psychological theory focused on how individuals interpret events and how this relates to their thinking and behavior, particularly how they assign causality to events and actions.

Q6: Dennis Corporation entered into a long-term lease

Q35: Under a capital lease,each monthly payment is

Q35: On May 1,2013,Monroe Corporation had 200,000 shares

Q50: The LIFO inventory method produces the most

Q52: When earnings from an investment exceed the

Q65: Independent contractor<br>A)Definite debts or obligations whose exact

Q136: Which of the following is an inventory

Q139: If a company uses LIFO for tax

Q154: Periodic and perpetual are examples of inventory

Q226: The cost of land would not include