Jet Corp.acquired all of the outstanding shares of Nittle Inc.on January 1, 2016, for $644,000 in cash.Of this consideration transferred, $42,000 was attributed to equipment with a ten-year remaining useful life.Goodwill of $56,000 had also been identified.Jet applied the partial equity method so that income would be accrued each period based solely on the earnings reported by the subsidiary.

On January 1, 2019, Jet reported $280,000 in bonds outstanding with a book value of $263,200.Nittle purchased half of these bonds on the open market for $135,800.

During 2019, Jet began to sell merchandise to Nittle.During that year, inventory costing $112,000 was transferred at a price of $140,000.All but $14,000 (at Jet's selling price) of these goods were resold to outside parties by year's end.Nittle still owed $50,400 for inventory shipped from Jet during December.

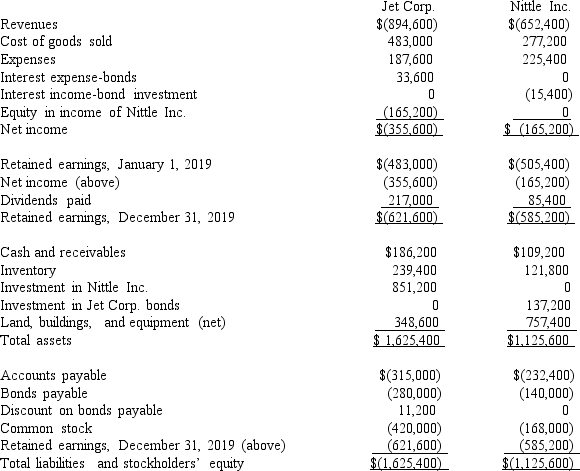

The following financial figures were for the two companies for the year ended December 31, 2019.

Required:

Required:

Prepare a consolidation worksheet for the year ended December 31, 2019.

Definitions:

Transactions

The action or process of conducting business or an instance of buying or selling in a market.

Sales Engineer

A professional who combines technical knowledge with sales skills to provide advice and support on a range of products.

Industrial Straight Rebuy

This term refers to a purchasing situation in which a business customer routinely reorders a product without any modifications.

Missionary Salesperson

A sales representative whose primary role is to promote the firm’s products indirectly, often by educating those who influence potential buyers, rather than making direct sales.

Q2: When a parent uses the initial value

Q15: A gift of any remaining estate property

Q31: After acquiring the additional shares, what adjustment

Q47: McLaughlin, Inc.acquires 70 percent of Ellis Corporation

Q51: Prepare a Charge and Discharge Statement for

Q72: Lawrence Company, a U.S.company, ordered parts costing

Q73: Compute the December 31, 2020, consolidated revenues.<br>A)

Q83: Required:<br>Prepare a schedule to show net income

Q89: Where can you find exchange rates between

Q115: What consolidation entry would be recorded in