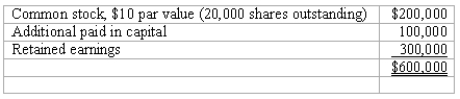

Panton, Inc.acquired 18,000 shares of Glotfelty Corp.several years ago for $30 per share when Glotfelty had a book value of $450,000.Before and after that time, Glotfelty's stock traded at $30 per share.At the present time, Glotfelty reports the following stockholders' equity:  Glotfelty issues 5,000 shares of previously unissued stock to Panton for $35 per share.

Glotfelty issues 5,000 shares of previously unissued stock to Panton for $35 per share.

Required: Describe how this transaction would affect Panton's books.

Definitions:

Preferred Providers Organizations

A type of health insurance plan that offers a network of healthcare providers from which patients can choose at a lower cost.

Insured Individual

A person covered by an insurance policy, receiving protection against specified risks in exchange for premiums paid to the insurer.

Insurer

An entity that provides insurance coverage, assuming the risk of loss in exchange for premium payments.

Copayments

Fixed amounts paid by patients for healthcare services, medication, or other goods, with the remaining costs covered by their insurance provider.

Q20: When is a goodwill impairment loss recognized?<br>A)

Q48: How are direct and indirect costs accounted

Q55: Compute consolidated retained earnings as a result

Q65: Compute the consolidated common stock at the

Q74: Which of the following statements is true

Q75: What two disclosure guidelines for operating segment

Q87: On January 1, 2018, Bast Co.had a

Q97: Determine the amortization expense related to the

Q106: With respect to the recognition of goodwill

Q112: In a tax-free business combination,<br>A) The income