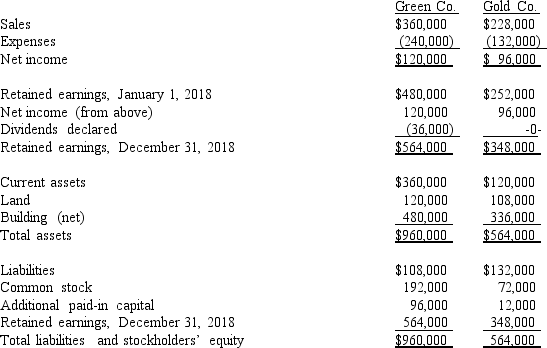

The following are preliminary financial statements for Green Co.and Gold Co.for the year ending December 31, 2018 prior to Black's acquisition of Blue.

On December 31, 2018 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold.Green's stock on that date has a fair value of $60 per share.Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000.Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.

On December 31, 2018 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold.Green's stock on that date has a fair value of $60 per share.Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000.Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2018 after the acquisition transaction is completed.

Definitions:

Q4: What was the balance in Eaton's Capital

Q6: On January 1, 2018, Vacker Co.acquired 70%

Q27: Compute Pell's investment account balance in Demers

Q45: What is normally required before a reorganization

Q52: Prepare any 2018 consolidation worksheet entries that

Q56: What is the total partnership capital after

Q62: All of the following statements regarding the

Q72: What is the purpose ofChapter 7 of

Q74: Included in the amounts for Pot's sales

Q86: Compare the differences in accounting treatment for