Use the information for the question(s) below.

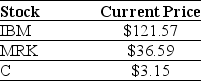

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) , three shares of Merck (MRK) , and three shares of Citigroup Inc. (C) . Suppose the current market price of each individual stock are shown below:

-An American Depository Receipt (ADR) is a security issued by a U.S.bank and traded on a U.S.stock exchange that represents a specific number of shares of a foreign stock.Siemens AG has an ADR that trades on the NYSE and is equivalent to one share of Seimens AG trading on the Frankfurt Stock Exchange in Germany.If Seimans trades for $95.19 on the NYSE and for €64.10 on the Frankfurt Stock Exchange,then under the law of one price,the current exchange rate is closest to:

Definitions:

Next Day

Referring to the day immediately following the present day.

Activate Alarm System

The process of turning an alarm system on to ensure it is operational and can alert in case of an emergency.

Hard Disk Drive

A data storage device used for storing and retrieving digital information using magnetic storage.

Hardware

Physical components of a computer system, such as the CPU, hard drive, and RAM.

Q8: If Firm A and Firm B are

Q22: Luther's EBIT coverage ratio for the year

Q33: You are offered an investment opportunity in

Q51: If ECE's return on assets (ROA)is 12%

Q53: The New Deal<br>A)may be summarized by these

Q62: What is the shape of the yield

Q85: If the ETF is currently trading for

Q134: Which of the following is true?<br>A)The completion

Q180: A country producing a combination of 5

Q212: The recession of 1937-38 could be blamed