Use the following information to answer the question(s) below.

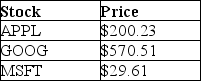

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of Apple Inc. (APPL) , one share of Google (GOOG) , and ten shares of Microsoft (MSFT) . Suppose the current stock prices of each individual stock are as shown below:

-Suppose that a security with a risk-free cash flow of $1000 in one year trades for $930 today.If there are no arbitrage opportunities,then the current risk-free rate is closest to:

Definitions:

Government Intervention

Actions taken by a government to affect or interfere with decisions made by individuals or organizations in order to correct market failures or achieve social goals.

Classical Economic Model

A framework in economics that emphasizes free markets, competition, and the minimal role of government intervention in the economy.

Corporate Social Responsibility Model

A strategic framework for companies to voluntarily incorporate social and environmental concerns into their business operations and interactions with stakeholders.

Maximizing Profits

The process of making the highest possible profit from business operations within the given market conditions.

Q1: Which of the following statements is false?<br>A)

Q1: Which of the following organization forms accounts

Q5: If the Krusty Krab's opportunity cost of

Q8: If the appropriate interest rate is 10%,then

Q14: Rearden's equity cost of capital is closest

Q27: Assume that you are 30 years old

Q48: Epiphany is worried about the reliability of

Q50: Assuming that Dewey's cost of capital is

Q228: Today farms with sales of more than

Q240: The decade that had the most stagflation