Use the information for the question(s)below.

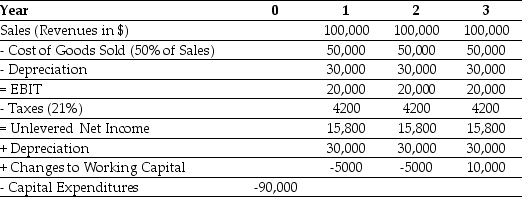

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany is worried about the reliability of the sales forecast.How sensitive is the project's NPV to a 10% change in sales?

Definitions:

Authentic Leadership

A leadership style that is characterized by genuine, transparent, and ethical behavior, where leaders are true to themselves and committed to their values.

Organizational Citizenship Behaviors

Voluntary behaviors employees perform to help others and benefit the organization, beyond their official job requirements.

Authentic

Genuine or true; being faithful to one's personality, spirit, or character despite external pressures.

Positive Psychological Capacities

Characteristics or mental states that contribute to a person's ability to thrive, such as resilience, optimism, and self-efficacy.

Q2: Which of the following statements is false?<br>A)

Q7: The expected return on the precious metals

Q19: Assuming that college costs continue to increase

Q24: MJ LTD is expected to grow at

Q24: Which of the following statements is correct?<br>A)

Q37: Based upon the price earnings multiple,the value

Q60: Which of the following statements is false?<br>A)

Q64: The expected return for Wyatt Oil is

Q65: The Sharpe ratio for the market (which

Q101: The variance on a portfolio that is