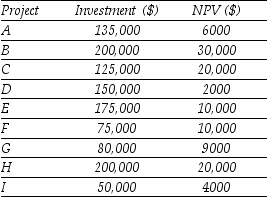

Use the table for the question(s) below.

Consider the following list of projects:

-Assume that your capital is constrained,so that you only have $600,000 available to invest in projects.If you invest in the optimal combination of projects given your capital constraint,then the total NPV for all the projects you invest in will be closest to:

Definitions:

Identical Twins

Twins that develop from a single fertilized egg, resulting in two genetically identical individuals.

Genotype

The genetic makeup of an organism determining its characteristics.

Phenotype

The set of observable characteristics or traits of an organism resulting from the interaction of its genotype with the environment.

Fraternal Twins

Siblings born at the same time who have developed from two different eggs fertilized by two different sperm, making them genetically distinct.

Q4: Consider the following timeline detailing a stream

Q5: For the year ending December 31,2009 Luther's

Q11: The incremental EBIT in the first year

Q18: If the YTM of these bonds decreases

Q18: The IRR for Galt Motors of manufacturing

Q40: A tax free municipal bond pays an

Q63: At an annual interest rate of 7%,the

Q71: Which of the following statements is false?<br>A)

Q81: Which of the following statements is false?<br>A)

Q95: Calculate the correlation between Stock Y's and