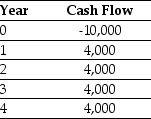

Use the table for the question(s) below.

Consider a project with the following cash flows:

-Assume the appropriate discount rate for this project is 15%.The payback period for this project is closest to:

Definitions:

Purchasing Power Parity

An economic theory that estimates the amount of adjustment needed on the exchange rate between countries so that an exchange is equivalent to each currency's purchasing power.

Eurobond

A bond issued in a currency other than the home currency of the country or market in which it is issued, often not subject to the regulations of a single country.

International Bond

A bond issued in a country by a non-domestic entity, often in a currency other than that of the issuer's country.

Purchasing Power Parity

An economic theory that compares different countries' currencies through a "basket of goods" approach to determine the relative value of currencies.

Q18: Assuming that Luther has no convertible bonds

Q26: Which of the following statements is false?<br>A)

Q47: When the Canadian federal government issues a

Q50: Which of the following statements is correct?<br>A)

Q68: The excess return is the difference between

Q80: The price today of a 3-year default-free

Q83: Monsters' beta with the market is closest

Q86: The amount of risk that is eliminated

Q86: Which of the following statements is false?<br>A)

Q92: What is the beta for a type