Use the following information to answer the question(s) below.

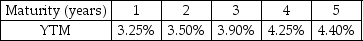

Suppose the current zero-coupon yield curve for risk-free bonds is as follows:

-The price per $100 face value of a four-year,zero-coupon,risk-free bond is closest to:

Definitions:

Slope

The measure of the steepness or incline of a line, indicating the rate at which values increase or decrease.

Diabetes

A chronic condition characterized by elevated levels of blood glucose (sugar) due to the body's inability to produce or effectively use insulin.

Obesity

A medical condition characterized by excessive body fat accumulation, which can lead to various health issues and decreased life expectancy.

Simple Linear Regression

A statistical method for understanding the relationship between two quantitative variables -- one predictor (independent variable) and one response (dependent variable) by fitting a linear equation.

Q8: You are opening up a brand new

Q9: If the discount rate for project B

Q16: Suppose that security C had a risk

Q17: Wyatt's current stock price is closest to:<br>A)

Q19: Which of the following statements is false?<br>A)

Q29: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q50: Assuming that Dewey's cost of capital is

Q56: Vacinox is a biotechnology firm that is

Q82: Assuming that Defenestration's dividend payout rate and

Q87: Which of the following formulas is incorrect?<br>A)