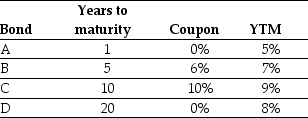

Use the table for the question(s) below.

Consider the following four bonds that pay annual coupons:

-The percentage change in the price of the bond "A" if its yield to maturity increases from 5% to 6% is closest to:

Definitions:

Patella

Also known as the kneecap, it is a small flat triangular bone located at the front of the knee joint.

Coccyg/o

Refers to the coccyx, the tailbone at the base of the vertebral column.

Chondr/o

Prefix in medical terminology meaning cartilage, relating to structures made of cartilage or conditions affecting cartilage.

Carp

A type of freshwater fish that is commonly found in rivers and lakes.

Q9: Floyd Ferris invested $3,000 into an account

Q10: Which of the following statements is false?<br>A)

Q11: Which of the following statements is false?<br>A)

Q12: The IRR for this project is closest

Q16: Which of the following statements is false?<br>A)

Q30: Which of the following statements is false?<br>A)

Q32: Assume that projects A and B are

Q38: Suppose that a young couple has just

Q40: If the expected return on the market

Q65: Rearden Metals expects to have earnings this