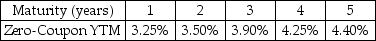

Use the following information to answer the question(s) below.

-The price today of a three-year default-free security with a face value of $1000 and an annual coupon rate of 4% is closest to:

Definitions:

Expected Utility Function

A mathematical representation of a decision-maker's preference over uncertain outcomes, emphasizing the expected level of satisfaction or value.

Probability

A numerical assessment between 0 and 1 indicating how probable it is for an event to take place.

Expected Value

The weighted average of all possible values of a random variable, with weights being their respective probabilities.

Probability

A measure quantifying the likelihood of a specific event occurring, often expressed as a number between 0 and 1.

Q10: If the appropriate discount rate for this

Q12: Consider two securities,A & B.Suppose a third

Q15: Assuming that Tom wants to maintain the

Q24: Consider a corporate bond with a $1000

Q51: Which of the following formulas is incorrect?<br>A)

Q69: If the discount rate for project A

Q69: If the current inflation rate is 5%,then

Q78: The beta of the precious metals fund

Q113: Assuming that the risk-free rate is 4%

Q127: Which of the following statements is false?<br>A)