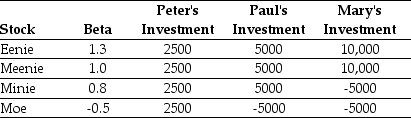

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's portfolio is closest to:

Definitions:

Endocytosis

A cellular process where a cell engulfs solid particles or liquids into a pouch which then becomes a vesicle.

Exocytosis

A cellular process in which intracellular vesicles fuse with the plasma membrane to release their contents outside the cell.

Adhesion Junctions

Specialized structures in cells that help in the binding of cells with each other or with the extracellular matrix.

Gap Junctions

Specialized intercellular connections that facilitate the direct transfer of ions and small molecules between the cytoplasms of adjacent cells.

Q1: The beta for the risk free investment

Q21: Which of the following statements is false?<br>A)

Q41: Which of the following statements is false?<br>A)

Q42: Suppose that to raise the funds for

Q63: Rearden Metal currently has no debt and

Q70: The yield to maturity for the three

Q81: If its YTM does not change,how does

Q100: Which of the following statements is false?<br>A)

Q105: What is the variance on a portfolio

Q113: Assuming that the risk-free rate is 4%