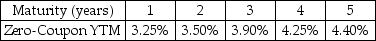

Use the following information to answer the question(s) below.

-Consider a four-year,default-free bond with an annual coupon rate of 4.5% and a face value of $1000.The YTM on this bond is closest to:

Definitions:

Market and Product Goals

Objectives that a business sets regarding where it wants its products to be in the market and the achievements it aims to attain with its product offerings.

Market-product Grids

Tools used to identify and map the relationship between a market segment and the product offering to meet the segment's needs.

Industry Trends

Patterns or movements that indicate the general direction in which a particular industry is moving over time.

Marketing Mix Actions

Marketing Mix Actions refer to the tactics and strategies a company uses across the 4P's (Product, Price, Place, Promotion) to promote and sell its products or services.

Q2: Kampgrounds Inc.is considering purchasing a parcel of

Q11: One of the IRR for Rearden's mining

Q36: In terms of present value,how much will

Q45: Assuming you just purchased 10,000 Bbls of

Q52: The British government has just issued a

Q58: Suppose over the next year Ball has

Q59: Assume the appropriate discount rate for this

Q61: Suppose you plan on purchasing Von Bora

Q66: Assuming that Luther's bonds receive a AAA

Q99: Nielson Motors plans to issue 10-year bonds