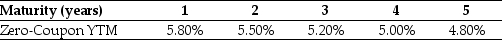

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The YTM of a 3-year default-free security with a face value of $1000 and an annual coupon rate of 6% is closest to:

Definitions:

Market Price

The actual selling price of a good or service in the marketplace, determined by supply and demand.

Price Takers

Market participants who accept prevailing prices because they have no power to influence the market price due to their small market share.

Perfect Competition

A market structure characterized by a large number of small firms, homogeneous products, free entry and exit, and perfect information, leading to firms being price takers.

Diminishing Marginal Returns

A principle stating that as more of a variable input is added to a fixed input, the additional output from each new unit of input will eventually decrease.

Q2: Kampgrounds Inc.is considering purchasing a parcel of

Q2: The expected return on the market rate

Q4: Consider an ETF that is made up

Q13: Assume that you are an investor with

Q32: California Gold Mining's beta with the market

Q36: The Market's average historical excess return is

Q58: Which of the following formulas is incorrect?<br>A)

Q62: If investors have relative wealth concerns,they care

Q77: Which of the following statements is false?<br>A)

Q80: Suppose you plan to hold Von Bora