Use the information for the question(s)below.

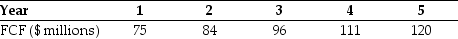

You expect DM Corporation to generate the following free cash flows over the next five years:  Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

-Calculate the enterprise value for DM Corporation.

Definitions:

Cumulative Preferred Stock

A type of preferred stock that accrues dividends if not paid out in the year they are due, ensuring investors receive dividends before common shareholders.

Dividends Payable

A liability representing the amount of dividends declared by a company's board of directors that have not yet been paid to shareholders.

Cash Dividend

A cash disbursement from a corporation to its shareholders, derived from its earnings.

Par Value

The face value of a bond or stock as stated on the certificate, which is the minimum amount the security can be sold for upon initial offering.

Q5: The Sharpe ratio for the efficient portfolio

Q6: The geometric average annual return on Stock

Q22: Assuming that the risk-free rate is 4%

Q35: A group of portfolios from which we

Q39: The incremental IRR of Project B over

Q64: Suppose you are a shareholder in d'Anconia

Q70: The CAPM does not require investors have

Q78: The expected return for Alpha Corporation is

Q91: Suppose the risk-free interest rate is 4%.If

Q116: The beta on Peter's Portfolio is closest