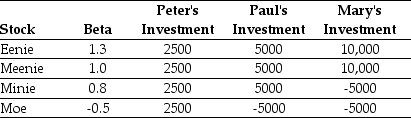

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's Portfolio is closest to:

Definitions:

Ethical Intensity

Ethical Intensity refers to the perceived importance or significance of an ethical issue, determined by its potential outcomes and the degree of impact on stakeholders.

Ethics-Based Principles

Moral guidelines that govern the behavior and decision-making of individuals or organizations.

Determination of Rights

The process of legally establishing or affirming individuals' entitlements or privileges under the law.

Organization's Culture

The shared values, beliefs, and practices that shape the social and psychological environment of a business or entity.

Q2: Which of the following statements is false?<br>A)

Q39: The variance on a portfolio that is

Q43: Which of the following statements is false?<br>A)

Q66: Which of the following agency problems represents

Q69: An exploration of the effect on NPV

Q78: Which of the following statements is false?<br>A)

Q79: Consider the following equation:<br>E + D =

Q82: Suppose over the next year Ball has

Q91: Which of the following is not a

Q97: Using just the return data for 2008,your