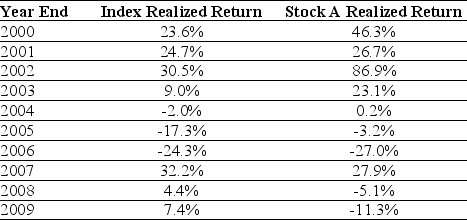

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on Stock A to forecast the expected future return on Stock A.The 95% confidence interval for your estimate of the expect return is closest to:

Definitions:

Physical Capital

Physical capital refers to tangible assets used in the production of goods and services, such as machinery, buildings, and equipment.

Terms of Trade

The ratio at which a country's exports exchange for its imports, affecting the economy's health.

Heckscher-Ohlin Theorem

An economic theory stating that countries export what they can most efficiently and plentifully produce, based on their factor endowments of labor, land, and capital.

Trade Flows

The movement of goods and services between countries or regions, highlighting the patterns and volumes of trade.

Q21: Your firm is planning to invest in

Q23: Assume that MM's perfect capital markets conditions

Q51: If RBC acquires POP,then the NPV of

Q60: Investors that suffer from a familiarity bias<br>A)

Q72: Which of the following statements is false?<br>A)

Q74: The incremental unlevered net income Shepard Industries

Q75: Suppose that you want to use the

Q78: The NPV for Galt Motors of manufacturing

Q96: The average annual return on the Index

Q100: Which of the following statements is false?<br>A)