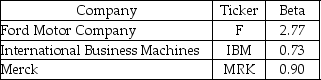

Use the following information to answer the question(s) below.

-If the market risk premium is 6% and the risk-free rate is 4%,then the expected return of investing in Merck is closest to:

Definitions:

Observational Data

Information collected through directly witnessing or recording physical occurrences and behaviors, without manipulating the environment or subjects.

Primary Data

Information collected directly by researchers through surveys, interviews, or experiments, specifically for their study’s purpose.

Facts And Figures

Quantifiable data and statistical information used to support arguments, make decisions, or present information in a clear and concise manner.

Newly Collected

Recently gathered information or data that has not been previously recorded or analyzed.

Q6: NoGrowth industries presently pays an annual dividend

Q17: The decision you should take regarding this

Q39: The free cash flow for the last

Q43: The depreciation tax shield for Shepard Industries

Q59: What is the relationship between a bond's

Q64: Which of the following statements is false?<br>A)

Q75: Assuming that Dewey's cost of capital is

Q78: Using the average historical excess returns for

Q86: The NPV for this project is closest

Q87: Which of the following statements is false?<br>A)