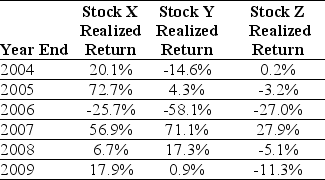

Use the table for the question(s) below.

Consider the following returns:

-The variance on a portfolio that is made up of equal investments in Stock × and Stock Y stock is closest to:

Definitions:

Assignment

The transfer of rights, property, or responsibilities from one party to another.

Factoring Of Receivables

The sale of a business's accounts receivable to a third party, at a discount, for immediate cash.

Accounts Receivable Period

The typical duration for an enterprise to gather owed payments from its customers.

Sale Of Inventory

The process of selling the goods that a business has produced or bought to its customers.

Q5: Assuming the appropriate YTM on the Sisyphean

Q41: What is sensitivity analysis?

Q45: Which of the following is not a

Q60: Assume that your capital is constrained,so that

Q65: Suppose the risk-free interest rate is 4%.If

Q75: Luther Industries has outstanding tax loss carryforwards

Q83: Assume that the corporate tax rate is

Q90: Which of the following statements is false?<br>A)

Q107: Which of the following statements is false?<br>A)

Q119: The weight on Abbott Labs in your