Multiple Choice

Use the table for the question(s) below.

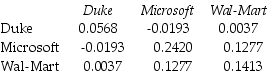

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investments in Duke Energy and a $4000 investment in Wal-Mart stock is closest to:

Definitions:

Related Questions

Q23: Assume that MM's perfect capital markets conditions

Q28: The incremental after tax cash flow that

Q38: If Flagstaff currently maintains a .5 debt

Q51: Which of the following formulas is incorrect?<br>A)

Q64: Suppose you are a shareholder in d'Anconia

Q70: Which of the following statements is false?<br>A)

Q78: Which of the following statements is false?<br>A)

Q78: Using the average historical excess returns for

Q100: Which of the following statements is false?<br>A)

Q106: The expected return on your of your