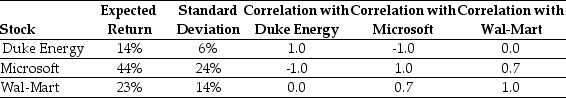

Use the table for the question(s) below.

Consider the following expected returns, volatilities, and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

Definitions:

Implied Warranty

A legal term for the guarantee or promise that a product will meet a minimum level of quality and functionality without being explicitly stated.

Particular Purpose

In a legal context, this refers to a specific use for which a product or service is intended or for which it is being sold to a consumer, who relies on the seller’s expertise.

Merchantability

A guarantee that a product will meet reasonable expectations of quality and usability for its intended purpose when sold.

Implied Warranty

A legal term referring to the assurances that a product will perform as expected, even though not explicitly stated by the seller.

Q5: Assuming the appropriate YTM on the Sisyphean

Q11: What is the excess return for Treasury

Q16: Which of the following statements is false?<br>A)

Q20: Your estimate of the asset beta for

Q50: Assume that five years have passed since

Q55: The YTM of a 3 year default

Q59: Two separate firms are considering investing in

Q71: Which of the following statements is false

Q79: The payback period for project Alpha is

Q88: Show mathematically that the stock price of