Use the following information to answer the question(s) below.

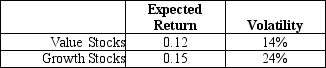

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The volatility on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Large Companies

Corporations that operate on a vast scale, often characterized by significant market share, diverse operations, and large workforce, contributing substantially to economic activities.

Strategic Plans

Long-term, overarching plans that outline how an organization will achieve its goals and objectives within a specific timeframe.

Operational Plans

Detailed, short-term action plans that outline how goals or objectives will be achieved within a specific timeframe.

Strategic Management Process

A continuous practice that involves planning, monitoring, analyzing, and assessment of all that is necessary for an organization to meet its goals and objectives.

Q1: What is the NPV of the Epiphany's

Q26: The weight on Lowes in your portfolio

Q29: Nielson Motors has no debt,and maintains a

Q56: Vacinox is a biotechnology firm that is

Q63: The equity cost of capital for "Miney"

Q70: The yield to maturity for the three

Q74: Consider the following formula: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q75: Wyatt Oil's average historical excess return is

Q81: The volatility on the market portfolio (which

Q100: Assuming your cost of capital is 6