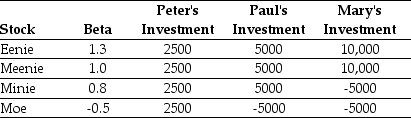

Use the table for the question(s)below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Explain how having different interest rates for borrowing and lending affects the CAPM and the SML.

Definitions:

Call Option

A financial contract giving the buyer the right but not the obligation to purchase a stock, bond, commodity, or other asset at a specified price within a certain time frame.

Exercise Price

The price at which an option holder can buy or sell the underlying security, determined at the time the option is issued.

Intrinsic Value

The actual, inherent worth of a financial asset, not influenced by its market price, often based on underlying fundamentals.

Call Option Contracts

Financial contracts that give the option buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset or instrument at a specified price within a specific time period.

Q1: Which of the following statements is false?<br>A)

Q3: The forward rate for year 3 (the

Q20: The price per $100 face value of

Q31: Assuming the appropriate YTM on the Sisyphean

Q34: Suppose you plan on purchasing Von Bora

Q38: The forward rate for year 5 (the

Q52: Which of the following statements is false?<br>A)

Q54: Which of the following statements is false?<br>A)

Q68: Which of the following statements is false?<br>A)

Q99: Nielson Motors plans to issue 10-year bonds