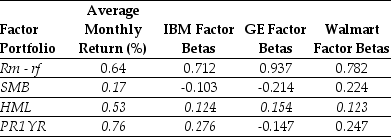

Use the table for the question(s) below.

Consider the following information regarding the Fama-French-Carhart four factor model:

-Using the FFC four factor model and the historical average monthly returns,the expected monthly return for IBM is closest to:

Definitions:

Angular Washing Machines

Washing machines designed with geometric or angular aesthetics, possibly to fit specific spaces or for modern design preferences. However, this term is not commonly used in a standard context; washing machines are usually not categorized by angularity.

FAB

Features, Advantages, and Benefits; a sales model that emphasizes communicating not just the features of a product, but also its advantages over other options and the benefits it offers to the consumer.

Marketing Plan

A strategic outline that lists an organization's goals for product sales, communication strategies with consumers, and the allocation of resources to achieve these objectives.

Q9: Which of the following statements is false?<br>A)

Q11: Portfolio "D"<br>A) falls below the SML.<br>B) has

Q15: Suppose that you have invested $30,000 invested

Q28: The Debt Capacity for Omicron's new project

Q34: Show mathematically that the stock price of

Q53: Omicron's enterprise value is closest to:<br>A) $500

Q53: Assume that you are an investor with

Q65: Assume that investors in Google pay a

Q81: Your firm currently has $250 million in

Q95: The effective dividend tax rate for a