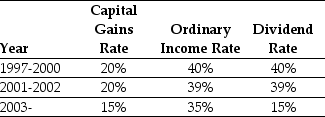

Use the information for the question(s) below.

Consider the following tax rates:  *The current tax rates are set to expire in 2008 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire in 2008 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a buy and hold individual investor in 2006 is closest to:

Definitions:

CD8

A protein found on the surface of T cells, involved in the immune response by identifying and attacking infected or cancerous cells.

Progenitor

An ancestor or parent from which descendants or offspring arise.

Plasma Cell

A type of white blood cell that produces and secretes large volumes of antibodies, playing a crucial role in the immune response.

Antigen Presenting Cells

Cells that process and present foreign antigens in a form that can be recognized by lymphocytes, initiating an immune response.

Q4: What range for the market value of

Q16: Which of the following statements is false?<br>A)

Q19: Using the binomial pricing model,the calculated price

Q20: Which of the following statements is false?<br>A)

Q24: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="The term

Q25: Calculate the effective tax disadvantage for retaining

Q35: Nielson Motors plans to issue 10-year bonds

Q60: If KT expects to maintain a debt

Q70: Assume that MM's perfect capital markets conditions

Q71: Wyatt Oil has a bond issue outstanding