Use the information for the question(s) below.

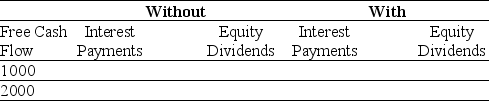

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

ATP Molecules

Adenosine Triphosphate molecules, the primary energy carriers in cells.

MyPlate

A visual guide created by the USDA to help Americans eat a healthier diet, which emphasizes the importance of proportioning different food groups on a plate.

USDA

United States Department of Agriculture, an agency overseeing food safety, agriculture, and related issues.

Healthful Meal

A meal that provides the necessary nutrients for good health, balancing proteins, fats, carbohydrates, vitamins, and minerals.

Q6: If the risk-free rate of interest is

Q27: The variance of the returns on Stock

Q32: Ideko's Accounts Receivable Days is closest to:<br>A)

Q65: An individual's desire for intense risk-taking experiences

Q72: Assume that Omicron uses the entire $50

Q91: Suppose the risk-free interest rate is 4%.If

Q91: Consider the following equation:<br>P<sub>retain</sub> = P<sub>cum</sub> <img

Q93: Consider a portfolio that consists of an

Q95: Calculate the correlation between Stock Y's and

Q97: Using just the return data for 2008,your