Use the information for the question(s) below.

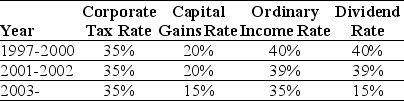

Consider the following tax rates:

*The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

-In 2006,Luther Incorporated paid a special dividend of $5 per share for the 100 million shares outstanding.If Luther has instead retained that cash permanently and invested it into treasury bills earning 6%,then the present value of the additional taxes paid by Luther would be closest to:

Definitions:

Spatial Skills

The ability to recognize, analyze, and manipulate shapes and figures in a given space.

Logical Reasoning

The process of analyzing a situation and coming to a conclusion based on a set of given rules or principles.

Motor Coordination

The ability to move and control body movements and positions efficiently through the coordinated action of muscles and the nervous system.

Gonads

The primary reproductive organs in animals that produce gametes; in males, they are the testes, and in females, the ovaries.

Q4: What range for the market value of

Q13: The amount of cash a firm needs

Q15: Assuming that Ideko has a EBITDA multiple

Q18: The unlevered cost of capital for "Moe"

Q24: Describe the two factors that affect the

Q25: Which one of the following is not

Q33: Which of the following statements is false?<br>A)

Q42: Suppose that MI has zero-coupon debt with

Q55: The Debt Capacity for Omicron's new project

Q81: Assume that Rockwood is able to repurchase