Use the table for the question(s) below.

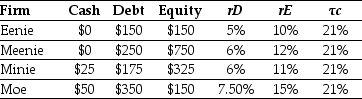

Consider the information for the following four firms:

-The unlevered cost of capital for "Moe" is closest to:

Definitions:

Liquidity Betas

A measure of how sensitive an asset's price is to changes in market liquidity, often used in financial modeling to assess the impact of liquidity risk.

Priced Factor

An element affecting the pricing of securities that is reflected in market prices due to its influence on asset returns.

Market Illiquidity

A situation in which an asset cannot be easily sold or exchanged for cash without a substantial loss in value.

Book-to-market Ratio

A valuation metric comparing the book value of a company to its market price.

Q7: Risk neutral probabilities are also known as

Q8: The price of a one-year American put

Q10: Which of the following statements is false?<br>A)

Q25: Based upon the price/earnings ratio,what would be

Q25: Calculate the effective tax disadvantage for retaining

Q38: Assume that to fund the investment Taggart

Q44: Which of the following statements is false?<br>A)

Q52: Suppose that MI has zero-coupon debt with

Q68: The alpha that investors in Galt's fund

Q78: Which of the following statements is false?<br>A)