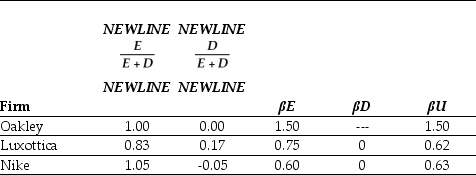

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Oakley is closest to:

Definitions:

Richardson Retractor

A surgical instrument used to hold back the edges of a wound or incision to provide access to the underlying organs or tissues.

Minor Surgical Procedure

Surgical interventions that are typically quick, pose little risk, and do not require an extended period of recovery.

Scheduling

The process of organizing, planning, and arranging activities or tasks within a given timeline, often used in healthcare to manage appointments and procedures.

Fast

To abstain from all or some kinds of food or drink, especially as a religious observance.

Q1: Which of the following statements is false?<br>A)

Q2: Corporate governance is best defined as<br>A) the

Q2: Which of the following statements is false?<br>A)

Q9: The Black-Scholes Δ of a one-year,at-the-money call

Q21: Which of the following statements is false?<br>A)

Q35: Which of the following statements is false?<br>A)

Q39: The after tax interest expense in 2008

Q49: The amount of net working capital for

Q67: If its managers increase the risk of

Q88: Which of the following statements is false?<br>A)