Use the following information to answer the question(s) below.

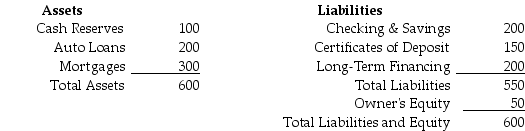

You are a risk manager for Security First Trust Savings and Loan (SFTSL) .SFTSL's balance sheet is as follows (in millions of dollars) :  The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

-If interest rates are currently 5%,but fall to 4%,your estimate of the approximate change in SFTSL equity is closest to:

Definitions:

Needs Analysis

The process of identifying and evaluating the needs of a specific group of people or organization to determine necessary actions for performance improvement.

Stakeholder Consultation

A process where stakeholders are given the opportunity to contribute their opinions and insights towards a project or decision before it is finalized.

Compliance Training

Instructional programs designed to inform employees of the organization's policies, regulations, and legal obligations to prevent violations and ensure workplace safety and ethics.

Health And Safety

Policies, procedures, and regulations implemented to prevent accidents and protect individuals from hazards in the workplace.

Q2: You are in the process of purchasing

Q5: Using risk neutral probabilities,calculate the price of

Q19: A(n)_ cash flows come from the cash

Q25: Assuming that Kinston does not have the

Q26: Bonds issued by a foreign company in

Q28: Which of the following statements is false?<br>A)

Q32: The present value of Rearden Metal's cash

Q33: Which of the following statements regarding commercial

Q36: In cash flow calculations,cash flow sign convention

Q39: Which of the following statements is false?<br>A)