Use the information for the question(s)below.

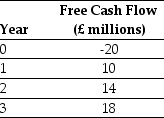

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-What is the pound present value of the project?

Definitions:

Q2: You are offered an investment opportunity in

Q7: Suppose that when these bonds were issued,Luther

Q12: Rylan Inc is considering a project that

Q17: When the value of one project depends

Q17: Which of the following statements is false?<br>A)

Q20: Based upon the information provided about securities

Q20: Suppose you plan to hold Von Bora

Q41: Which of the following statements is false?<br>A)

Q42: Which of the following statements is false?<br>A)

Q66: With month payment of $580 into a