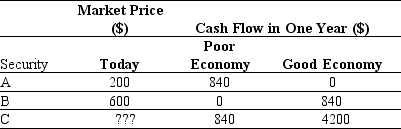

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,what risk premium is appropriate for this security?

Definitions:

Critical Thinking Error

A mistake in reasoning or process in evaluating information, leading to incorrect conclusions or judgments.

Preparedness

The state of being ready and able to deal with specific situations or emergencies.

Cognitive Development

The process by which one becomes an intelligent person.

William Perry

An American educator and psychologist known for his theory of intellectual and ethical development in college students.

Q6: Which of the following statements is false?<br>A)

Q6: To calculate the annual Capital Cost Allowance

Q25: Because the cash flows from owning a

Q33: Suppose you plan to hold Von Bora

Q36: Which of the following statements is false?<br>A)

Q43: Collection float is made up of all

Q48: Assume the appropriate discount rate for this

Q60: JRN Enterprises just announced that it plans

Q74: The forward rate for year 2 (the

Q86: Which of the following statements is false?<br>A)