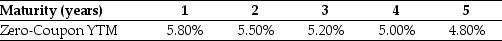

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 2 (the forward rate quoted today for an investment that begins in one year and matures in two years) is closest to:

Definitions:

Avoidance

Avoidance is a strategy or behavior aimed at sidestepping or evading certain situations, conflicts, or responsibilities.

Strategy

An approach devised for the purpose of achieving a long-term or primary aim.

Tactics

Carefully planned strategies or maneuvers intended to achieve a specific end, often used in contexts of negotiation, conflict resolution, or competitive situations.

Strategy

A comprehensive plan or set of actions designed to achieve specific goals.

Q5: The first step in evaluating a project

Q8: Suppose you invest $15,000 in Merck stock

Q14: If the risk-free interest rate is 10%,then

Q16: If interest rates are currently 5%,but fall

Q20: The expected return of a portfolio that

Q36: Another oil refiner is offering to trade

Q36: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q59: Net Present Value can be calculated for

Q63: Which of the following statements is false?<br>A)

Q75: If CCM has $150 million of debt