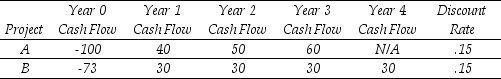

Use the table for the question(s) below.

Consider the following two projects with cash flows in $:

-The internal rate of return (IRR) for project B is closest to:

Definitions:

Goodwill

An intangible asset that arises when a business is acquired for more than the fair value of its net identifiable assets, representing non-physical assets like brand reputation and customer loyalty.

Book Value Decrease

A reduction in the book value of an asset, often due to depreciation, impairment, or disposal.

Inventory Of Minerals

An itemized catalog of mineral resources that a company has in its possession, which can include raw materials, work-in-progress, and finished goods.

Net Income

The net income of a business following the deduction of all taxes, expenses, and costs from its total revenue.

Q14: Which of the following statements is false?<br>A)

Q18: Assuming that Luther has no convertible bonds

Q25: Consider an investment that pays $1,000 with

Q37: You are considering using the incremental IRR

Q40: Which of the following investments offered the

Q46: Following the Sarbanes-Oxley Act in United States,Canadian

Q54: Do expected returns for individual stocks increase

Q86: Sovereign bonds,unlike corporate bonds,are insulated from default

Q92: If there is a significant risk that

Q101: A 3-year default-free security with a face