Multiple Choice

Use the table for the question(s) below.

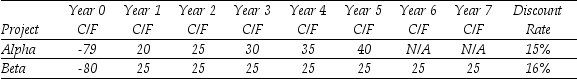

Consider the following two projects with cash flows in $:

-The internal rate of return (IRR) for project Alpha is closest to:

Definitions:

Related Questions

Q18: Assuming that Luther has no convertible bonds

Q38: If the risk-free interest rate is 10%,then

Q40: Portfolio "A"<br>A) has a relatively lower expected

Q44: If a stock pays dividends at the

Q52: Which of the following equations is incorrect?<br>A)

Q67: Portfolio "C"<br>A) is less risky than the

Q67: Consider the following timeline detailing a stream

Q75: To apply the payback rule,you calculate the

Q97: Which of the following statements is false?<br>A)

Q97: Consider an equally weighted portfolio that contains