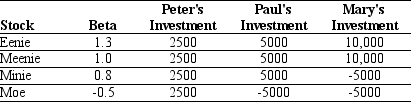

Use the table for the question(s)below.

Consider the following three individuals' portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then calculate the required return on Mary's portfolio.

Definitions:

Unipolar Depression

A mood disorder involving persistent feelings of sadness, loss, or anger that interfere with a person's everyday activities.

Maladaptive Attitudes

Cognitive beliefs or thoughts that are disproportionately negative and can lead to emotional distress or mental health issues.

Depressive Symptoms

Signs that may indicate depression, including persistent sadness, lack of interest in activities, and changes in sleep or appetite.

Cognitive-behavioral Therapy

A form of psychotherapy that treats problems and boosts happiness by modifying dysfunctional emotions, behaviors, and thoughts.

Q5: The cost of capital is the best

Q9: The standard deviation of the return on

Q28: If the appropriate discount rate for this

Q34: Which of the following statements is false?<br>A)

Q57: Suppose that Defenestration decides to pay a

Q60: What is the expected payoff for Big

Q78: The variance on a portfolio that is

Q79: The cost of capital of levered equity

Q86: The amount of risk that is eliminated

Q98: The standard deviation for the return on