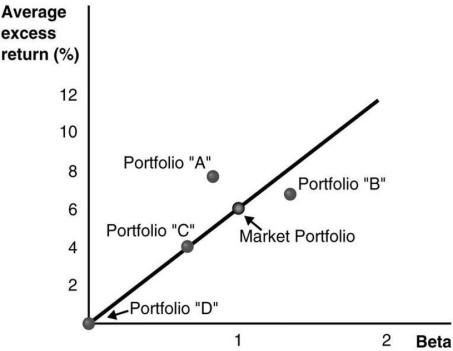

Use the figure for the question(s) below.Consider the following graph of the security market line:

-Which of the following statements regarding portfolio "B" is/are correct? 1.Portfolio "B" has a positive alpha.

2.Portfolio "B" is overpriced.

3.Portfolio "B" is less risky than the market portfolio.

4.Portfolio "B" should not exist if the market portfolio is efficient.

Definitions:

Total Rate of Return

A measure of the total gain or loss on an investment over a specified period, including both capital gains and dividends or interest.

Total Dollar Return

The overall financial gain or loss on an investment, expressed in dollars, including dividends, interest, and capital gains.

Dividend Payments

Cash payments made by a company to its shareholders as a distribution of profits.

Variance

A statistical measurement of the dispersion of a set of data points, reflecting how much each number in the set differs from the mean.

Q11: Which of the following statements is false?<br>A)

Q14: Assume that MM's perfect capital markets conditions

Q33: Which of the following statements is false?<br>A)

Q41: Which of the following statements regarding portfolio

Q45: The average annual return on IBM from

Q49: Which of the following is NOT one

Q63: In Canada,the Canadian Revenue Agency (CRA)has direct

Q66: The incremental unlevered net income for Shepard

Q73: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1623/.jpg" alt="The term

Q84: Assume that MM's perfect capital markets conditions