Use the information for the question(s) below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt. KD has had consistently stable earnings, and pays a 15% tax rate. Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

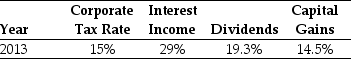

-Assume the following tax schedule:

Personal Tax Rates

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization.

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization.

Definitions:

API Gravity

A measure of how heavy or light a petroleum liquid is compared to water, used in the oil and gas industry to classify oils.

Pearson Correlation

A measure of the linear relationship between two quantitative continuous variables, ranging from -1 to 1, where 1 means a perfect positive correlation and -1 a perfect negative correlation.

Price Per Barrel

The cost of a barrel of goods, commonly used to denote the cost of a barrel of crude oil in financial markets.

Confidence Interval Estimate

A confidence interval estimate provides a range of values, derived from sample data, that is likely to contain the value of an unknown population parameter, along with a given level of confidence.

Q12: When the investment cannot be delayed,the optimal

Q18: Which of the following statements is correct?<br>A)

Q28: Which of the following statements is false?<br>A)

Q32: Which of the following statements is false?<br>A)

Q34: Which of the following statements is false?<br>A)

Q43: Studies have shown that a market indexed

Q45: Iota's weighted average cost of capital is

Q47: Monsters' required return is closest to:<br>A) 10.0%<br>B)

Q55: When the market portfolio is not efficient,theory

Q92: If there is a significant risk that