Use the information for the question(s) below.

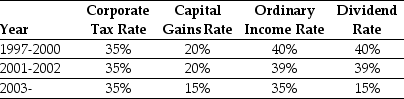

Consider the following tax rates:

The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

-In 2006,Luther Industries paid a special dividend of $5 per share for the 100 million shares outstanding.If Luther had instead retained that cash permanently and invested it into Treasury Bills earning 6%,then the present value of the additional taxes paid by Luther would be closest to:

Definitions:

Government Bonds

Debt securities issued by a government to support government spending and obligations, typically offering a fixed rate of return over a specified period.

Market Rate

The market rate refers to the prevailing interest rate available in the marketplace for financial products or the current price of goods and services in a competitive market.

Vault Cash

Physical currency that banks and other depository institutions hold in their vaults, used to meet customer withdrawals and other immediate needs.

Federal Reserve

The central banking system of the United States, responsible for monetary policy, regulation of financial institutions, and maintaining financial system stability.

Q5: Which of the following statements is false?<br>A)

Q16: The interest rate tax shield for Kroger

Q28: Which of the following statements is false?<br>A)

Q46: Prior to an IPO,in Canada,the first step

Q47: Which of the following statements is false

Q47: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1623/.jpg" alt="The term

Q54: An over-investment problem means that shareholders have

Q82: Describe the key steps to determine the

Q87: The idea that when a seller has

Q88: Assume that management makes a surprise announcement