Use the information for the question(s)below.

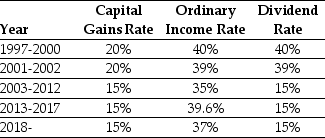

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

-Using the available tax information for 2002,calculate the effective dividend tax rate for a:

(1)one-year individual investor

(2)buy and hold individual investor

(3)pension fund

Definitions:

Fat-Free Chocolate

Chocolate that has been manufactured without any fat content, often substituted with other ingredients to maintain texture and taste.

Product

An item or service created as a result of a process, which is offered in the market to satisfy the needs or wants of a customer.

Premium

Additional payment higher than the normal cost, often for enhanced benefits or services in various contexts, such as insurance or memberships.

Complimentary Approach

A sales strategy that involves giving praise or providing free products or services to potential customers to engender goodwill and facilitate sales.

Q6: Luther Industries is currently trading for $27

Q15: Suppose that to raise the funds for

Q17: Which of the following statements is false?<br>A)

Q20: In the example of Canada Motors on

Q23: The amortization expense may be used for

Q30: KD Industries' stock is currently trading at

Q42: Consider the following equation: β<sub>U</sub> = <img

Q43: Value can be created by _ to

Q52: Assume that in the event of default,20%

Q81: KAHR Incorporated will have EBIT this coming