Essay

Use the table for the question(s)below.

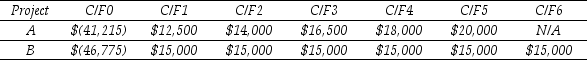

Consider two mutually exclusive projects with the following cash flows:

-If the discount rate for project B is 15%,then what is the NPV for project B?

Definitions:

Related Questions

Q12: Wyatt oil is contemplating issuing a 20-year

Q44: Which of the following statements is FALSE?<br>A)

Q46: You are considering adding a microbrewery on

Q46: At an annual interest rate of 7%,the

Q55: Do expected returns for individual stocks increase

Q58: The equity cost of capital for "Meenie"

Q61: The NPV profile<br>A) shows the payback period

Q78: If RBC acquires POP,then the NPV of

Q78: Assume that you purchased J.P.Morgan Chase stock

Q82: The NPV for Epiphany's Project is closest