Use the information for the question(s) below.

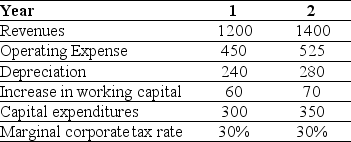

Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected the project will produce the following cash flows for the first two years (in millions) .

-The free cash flow from Shepard Industries project in year two is closest to:

Definitions:

Positive Cash Flows

The situation where a company's cash inflows exceed its cash outflows, indicating financial strength and the ability to finance operations, debt, and investments.

NPV

Net Present Value, a method used in capital budgeting to assess the profitability of an investment or project, calculating the difference between the present value of cash inflows and outflows.

Required Return

Required return is the minimum profit or gain needed from an investment to make it worthwhile, considering the risk involved and the opportunity cost of forgoing other investments.

IRR

The internal rate of return, a metric used to evaluate the profitability of potential investments.

Q10: A company that manufactures copper piping is

Q12: Which of the following statements is FALSE?<br>A)

Q22: You have an investment opportunity in Germany

Q25: Which of the following statements is FALSE?<br>A)

Q35: The NPV profile graphs:<br>A) the project's NPV

Q52: You expect Whirlpool Corporation (WHR)to have earnings

Q64: Consider a zero coupon bond with 20

Q86: The covariance between Stock X's and Stock

Q87: Which of the following statements is FALSE?<br>A)

Q92: Nielson Motors plans to issue 10-year bonds