Use the table for the question(s) below.

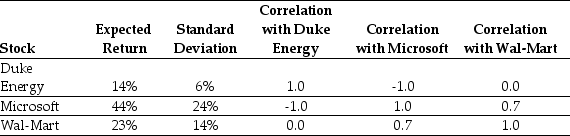

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

Definitions:

Hallucinogens

Substances that cause profound changes in perception, thought, and mood, often leading to visual or auditory hallucinations.

Depressants

Substances that reduce the activity of the central nervous system, leading to relaxation, reduced anxiety, and sleepiness.

Stimulants

Substances that increase arousal, attention, and energy by enhancing the activity of certain neurotransmitters in the brain.

Psychological Health

A state of well-being in which an individual recognizes their own abilities, can cope with the normal stresses of life, work productively, and contribute to their community.

Q3: The term a<sub>s </sub>is a(n):<br>A) error term

Q18: When choosing between projects,an alternative to comparing

Q22: Common risk is also called:<br>A) diversifiable risk.<br>B)

Q31: Which of the following statements regarding portfolio

Q32: The weight on Lowes in your portfolio

Q42: The standard deviation of the overall payoff

Q56: In a world with taxes,which of the

Q58: The geometric average annual return on the

Q98: Suppose that you want to use the

Q101: The Market's average historical return is closest