Use the table for the question(s) below.

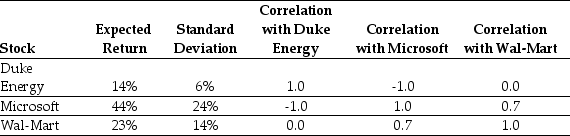

Consider the following expected returns,volatilities,and correlations:

-Which of the following statements is FALSE?

Definitions:

Outlining Process

The method of organizing thoughts or information into a structured summary, often used as a preliminary step in writing or project planning.

Main Ideas

The central or most important concepts or arguments presented in a text.

Intensive Listening

Focused and attentive listening aimed at understanding and analyzing the content of an audio message.

Pleasure

A feeling of satisfaction or joy experienced when enjoying something or in response to achieving something desirable.

Q4: If Rosewood had no interest expense,its net

Q32: If your new strip mall will have

Q36: Consider a corporate bond with a $1000

Q38: Suppose you plan to hold Von Bora

Q42: Suppose that to raise the funds for

Q58: If the Krusty Krab's opportunity cost of

Q66: If in the event of distress,the present

Q86: The percentage change in the price of

Q97: Which of the following statements is FALSE?<br>A)

Q98: Assuming that Tom wants to maintain the